The company's strategic development plan is divided into three stages, gradually expanding from aluminum wheels to high-end tooling equipment and lightweight design solutions, to meet the needs of various application fields such as automobiles, high-speed rail, aviation, electronics, and military industry

Medium - and short-term marketing strategies

Forged aluminum wheel hub front installation market (for OEM car manufacturers)

· Through the multinational automotive OEM and domestic vehicle customer resources accumulated by the founder and brother companies over the years, the company can quickly drive the forging of aluminum wheel hub products to the mainstream automotive market.

· Directly supplying the domestic vehicle market, while also manufacturing wheel hubs for brands in Europe, Japan, and the United States.

· China National Automobile (Beijing) Automotive Lightweight Technology Research Institute Co., Ltd. (established by 17 automotive industry shareholders including FAW Group, Dongfeng Motor, and Jida Holdings), as well as the Automobile Association and other leading units in the automotive lightweight industry, closely monitor our wheel hub improvement technology.

Forged aluminum wheel hub aftermarket (aimed at consumers)

· Utilize existing resources and large platforms to collaborate with tire alliances and associations in various regions; Expanding channels include the China Association of Automobile Repair Industries, the China Parts Association, the China Modification Association, and so on.

· Actively develop provincial and municipal agents as flagship stores.

· Establish a professional hub e-commerce online and offline service platform.

· Using modern marketing tools and big data platforms, quickly promote to terminal auto repair shops and beauty shops across the country.

Company's Medium - and Long Term Expansion Plan - Four Dimensional Industrial Motherboards and Lightweight Design

1. With the continuous growth of lightweight requirements and personalized consumer demand for automobiles, forged aluminum wheels will replace traditional materials and processes, with huge development space

· Front end market: It is expected that global sales of new energy vehicles will steadily increase, surpassing 30 million units by 2025. The demand for aluminum wheels will reach 84 million units, with a market size of approximately 13 billion US dollars.

· Aftermarket: It is expected that the global aftermarket demand for aluminum wheels will reach 56 million units by 2025, with a market size exceeding 8 billion US dollars.

· Aluminum wheels are one of the important links in global automotive lightweighting. Forged aluminum alloy wheels have excellent comprehensive performance such as beautiful appearance, good dynamic balance, high roundness, and fast heat dissipation, and are gradually replacing cast and steel wheels as the best choice.

2. The disruptive forging technology of the company can significantly reduce investment and production costs, improve production efficiency, and promote industrial economic sharing, changing the situation of limited production capacity and low loading rate of forged aluminum wheels at home and abroad

· The main development constraints faced by the existing aluminum alloy wheel hub forging technology include huge equipment investment, high material costs, and low production efficiency, resulting in a loading rate of less than 5% for domestic forged aluminum wheels. In addition, the loading rate in developing countries is about 15%, while the loading rate in developed countries is about 40%. The potential for the front and rear loading markets is also enormous.

· The self-developed key forging equipment and molds include: dual station 10000 ton forging press and supporting mold combination, dual station CNC machining center, etc.

· Compared to traditional forging lines, the company's large production line requires only 1.2 billion yuan (or 760 million yuan for the middle line) in investment, a 45% reduction, a 60% reduction in single wheel hub cost, a 3-fold increase in production line speed, and a 90% increase in milling efficiency.

3. The company has received attention and recognition from domestic and foreign automobile OEM manufacturers and major industry associations, with an order volume exceeding 100 billion yuan in the next three years; It is expected that the annual sales revenue will exceed 100 billion yuan in five years, and the net profit margin will reach over 40%

· The founder and brother companies have accumulated rich resources of multinational automotive OEMs and domestic vehicle customers over the years, which can quickly push the company's forged aluminum wheel hub products to the mainstream automotive market. At present, potential OEM customers include BYD, Tesla, Geely, NIO, Nezha, Leading, Dongfeng, Changan, Daimler, FAW, SAIC, BAIC, etc.

· In terms of exports, we have a strategic cooperation with the general agent, Audbax, and have an annual sales volume of over 30 million units throughout Japan.

· The expected sales revenue for 2022 is 470 million yuan, and with the continuous expansion of production capacity, the expected sales revenue for 2027 will exceed 130 billion yuan.

· Disruptive equipment and processes will bring ultra-high profit margins, with an average operating profit margin of 49% and a net profit margin of 41% over the next five to six years.

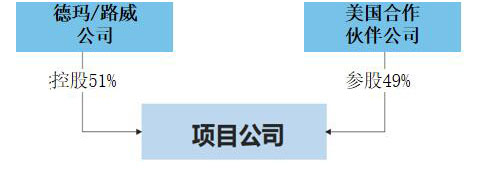

Cooperative investment methods

The investment funds for this project are based on the establishment of industrial investment funds, equity direct investment and other diversified cooperative investment forms as the operation and management foundation, ensuring that the project construction is implemented step by step according to the established total scale goals, and achieving a win-win situation through IPO on the main board.

Fundraising and arrangement of investment funds

-The project funds from both parties will be invested in the project company at once for the purchase of production lines and corresponding factory construction.

-The working capital of the project company is raised by the project company itself, with appropriate liabilities and financing. The profit sharing of the project company is decided by the board of directors of the project company.

-The US holds 49% of the shares and enjoys 30% of the voting rights, while other equity rights remain unchanged.

Ways of fund entry and exit

Fund entry: 1. Establishment of special industrial investment funds 2. Direct equity investment method

Fund withdrawal: 1. Listing withdrawal 2. Repurchase withdrawal

Policy requirements for project implementation

1. Can provide approximately 200 acres of industrial plant construction land at once, reserve 100 acres of talent apartment land, or reserve 600 sets of talent apartments for employees to use.

2. The best location for the project is less than 150 kilometers from the port, and it is ensured that there are 1-2 automobile manufacturers within 300 kilometers around, which is convenient for supporting supply.

3. Investors support the production of 6061 aluminum rod raw materials (with an annual output of over 600000 tons), ensuring at least one manufacturer and a transportation distance within 200 kilometers.

4. Priority should be given to landing in areas with raw materials such as magnesium ingots and aluminum ingots.

- Brand

- About Landwheels

- Product Advantages

- Development History

- Certificate of Honor

- Plant and Equipment

- Products

- Land Wheels

- Derma

- Industrial investment

- Land Wheels

- Derma

- QRcode

Technical support:和众互联 浙ICP备********号-2